Statistics Confirm That the Seller’s Market Evaporated by the End of 2024

Also: New app adds neighborhood politics as a search criterion; also, two big price reductions on our listings.

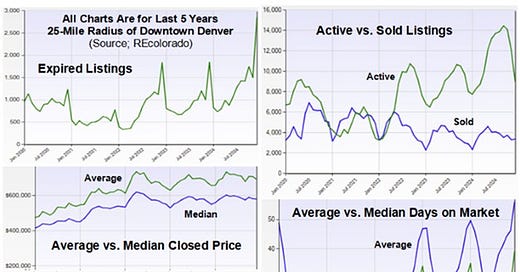

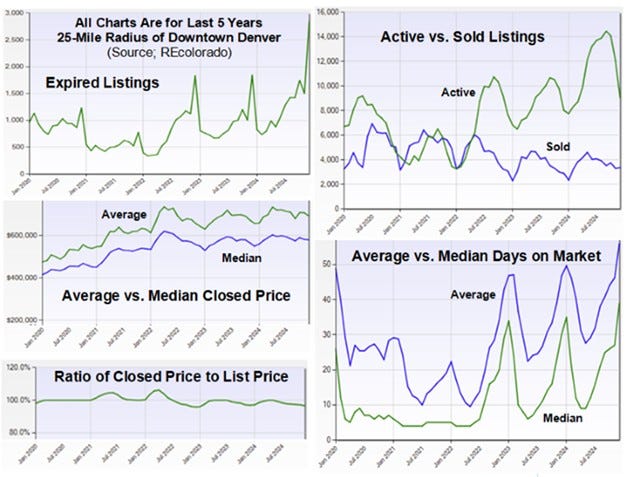

Now that 2024 has ended, we can see quite clearly that the seller’s market created during the Covid pandemic is now a thing of the past. December was a particularly slow month in a year that saw a great increase in the number of active listings, but little or no corresponding increase in sales, plus some other negative metrics, as shown in these charts:

As always, I derive these statistics from REcolorado, the Denver MLS, drawing all numbers from a 25-mile radius of downtown Denver instead of using the multi-county “metro Denver” stats reported by the Denver Metro Association of Realtors.

The most reliable and obvious indicator of a slowing market is how many listings expire without selling, and that number reached nearly 3,000 in December, about triple the figures for the first two Decembers of the pandemic, 2020 and 2021.

The ratio of closed price to listing price is another key indicator of a seller’s market. It peaked at 106.1% in April 2022, but has been as low as 92.0% since then.

The median sold price has leveled off but is still higher this December than all previous Decembers. Sellers are overpricing their homes when they first put them on the market, leading to that lower ratio when they finally sell.

The median time on market ranged from 4 to 6 days throughout the pandemic but has risen steadily since the fall of 2022 and is at its highest level in recent history now — 39 days. The average days on market is now 56 days. This compares to 30 days and 47 days respectively at the end of 2023.

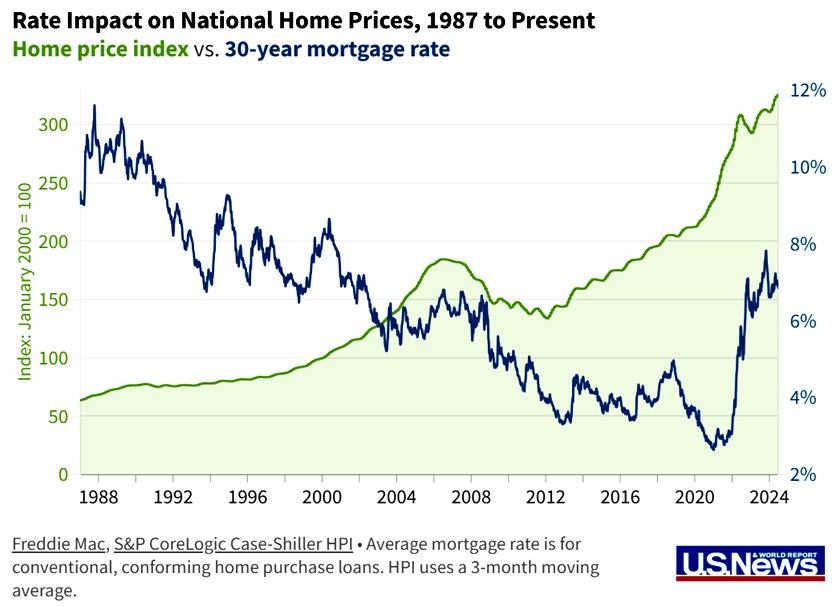

A big factor in the real estate market is always the cost of mortgage loans. Above is a graphic from USNews that charts the impact of interest rates on home prices from 1987 to present. Here’s how USNews interprets that chart:

“With mortgage rates at 3% or even lower, more homebuyers could afford to enter the market in the early 2020s. Home sales activity picked up, but housing inventory was insufficient to keep up with demand. Decades of housing underproduction in the U.S. meant that there were now more homebuyers than homes for sale, which fostered competition and drove home prices to unforeseen levels. From the start of the pandemic in March 2020 until the Federal Reserve began hiking rates in March 2022, home prices grew 37%, per Case-Shiller.

“In late 2022, home sales activity came to an abrupt halt when mortgage rates climbed from about 3% to above 7% in a matter of months. Buyers are still facing higher mortgage rates than they’ve seen in recent memory. On top of that, home prices are still staying stubbornly high after the pandemic housing boom. For many, especially first-time homebuyers who lack tappable equity, monthly mortgage payments have become too expensive at these new interest rates.

“The housing market is in a mortgage rate stalemate: Homebuyers are priced out, and homeowners are reluctant to sell and trade-in their low mortgage rates.”

So what should we expect in 2025?

Whenever there’s a market slowdown, it results in pent-up demand later on. And I foresee that pent-up demand expressing itself this month and this year in a more balanced market.

The big increase in inventory shows that sellers are beginning to accept that interest rates will stay at present levels, so they are no longer waiting for them to go down before sacrificing their current low-interest rate loan to purchase a replacement home. Likewise, I foresee buyers accepting current interest rates as the “new normal” and getting off the fence.

New Platform Adds Neighborhood Politics as a Search Criterion

Nearly one-quarter of Americans say local and national politics highly influence their decision about where to live, according to a recent survey from Realtor.com. In some age groups, that percentage is even higher.

“With both local and national politicians making decisions that impact daily life, both socially and fiscally, it makes sense that many would prefer to live in areas where the politics align with their own beliefs,” according to Danielle Hale, Realtor.com’s chief economist.

Many of the respondents to a Realtor.com survey said their political views do not align with those of their neighbors, and 17% have considered moving for that reason. That percentage was 28% for the millennial generation, who are also the most likely – at 33% - to report that their decisions about where to live are highly influenced by national politics. Among Gen Z respondents, 25% say politics influence their decisions, and among Gen X, it’s 21%. Only 16% of baby boomers felt that way.

Now a company called Oyssey has entered the home search business with a platform that includes all the usual criteria plus neighborhood politics.

Calling Oyssey a “platform” minimizes the company’s intention, which is to replace Zillow as the go-to real estate search engine by providing more information about listings — including neighborhood politics.

Currently, the platform is sold to individual real estate brokers who can invite individual buyers to access it. It’s strictly a buyer’s tool, and brokers will still be using their current MLS for listing homes for sale. The idea is that Oyssey would replace buyer tools, such as email alerts, built into the MLS, and that the buyer agency agreements now required by the NAR settlement would be built into its functionality.

The platform was introduced last month in south Florida and New York City, but should be available elsewhere, including Colorado, in 2025. I am the first Colorado broker to have signed up for it when it comes to our market.

Price Reduced by $100,000 on This 5-Bedroom Brick Ranch in Wheat Ridge - Now $650,000

There’s so much to love about this home at 7085 W. 32nd Place! For starters, it’s a handyman’s delight with its oversized 2-car garage that is heated and has 200 Amps of power, including two 240-Volt circuits. Also, a basement bedroom has been converted into a sound studio with professional soundproofing such that neighbors and the people upstairs wouldn’t hear any sounds emanating from it. Altogether, including that studio with its ensuite bathroom, this home has five bedrooms and three full bathrooms. And it has a full-size bar with bar stools next to that studio in the basement. Under the new state law, the basement could be adapted into a 2-bedroom/1-bathroom accessory dwelling unit (ADU) to provide extra income for the owner. To fully appreciate this impressive home, which has been owned and lovingly maintained by the seller for 43 years, take the narrated video tour below, then come to the open house Saturday, 11 a.m. to 1 p.m. Or call Kathy Jonke at 303-990-7428 for a private showing. More details at www.GRElistings.com.

Price Reduced on 2-Bedroom Downtown Golden Condo - Now $735,000

Condos in this building at 722 Washington Avenue (called Washington Station) are in great demand because of its location in downtown Golden. This listing is Unit 201, which has a great corner location directly above the unit’s deeded parking spot. Moreover, the stairs to the parking garage are right next to the door to this unit. (There’s also an elevator.) This is a mixed-use building, with commercial units on the main and 2nd floor. The unit itself features an open floor plan, with slab granite countertops and cherry cabinets with handles, and an island with breakfast bar to complement the dining area. There’s a balcony outside the living room. It and all windows have mountain views. The bathrooms and kitchen have ceramic tile floors, and the rest of the unit has carpeting in good condition. There’s a 7’-deep storage room and laundry closet with vinyl flooring. Take the narrated video tour below, then come to the open house this Saturday, 11am to 1pm. Or call Jim Smith at 303-525-1851 to request a private showing. More details at www.GoldenCondo.info.

Remembering and Honoring Jimmy Carter

This item was not published in the Denver Post. It appears only on my other Substack newsletter: http://TalkingTurkey.substack.com.